Why stock prices are soaring while the economy is collapsing

From https://www.youtube.com/watch?v=7cU9AzSpNio

The NASDAQ reached an all-time high last week while unemployment soars and GDP is tanking. What’s up? I’ve heard plenty of talking heads describe how the equity markets reflect optimism for COVID-19 vaccines and whatnot, but after watching this video (thanks for the tip, Azzam), things are much clearer:

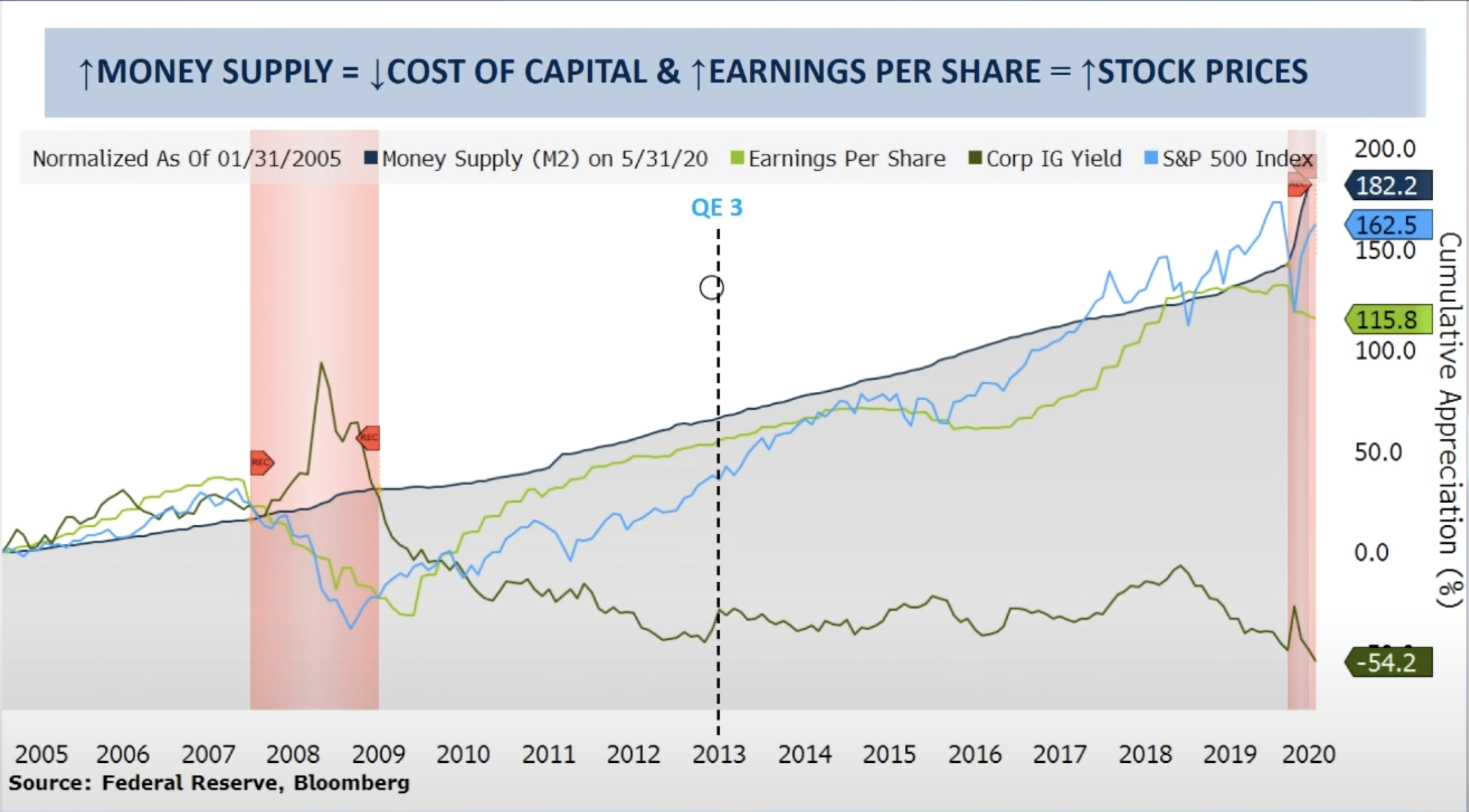

Long story short, as the Fed pumps trillions into the monetary supply, lowers interest rates, and buys corporate bonds, corporations are using that cheap cash to buy back stock, which is inflating prices.

That’s it. It has nothing to do with current/anticipated growth or profits. It’s embarrassingly simple.

I’m surprised-not-surprised this isn’t getting more attention. While I’m sure all you savvy economists out there are well ahead of this, the rest of us are just getting up to speed.

I have questions. I’ll keep these answers updated as I learn more. (I’m not an economist, so shoot me an email at will@wclittle.com or hit me up on Twitter if you have thoughts/ideas/corrections):

- Can the Fed really just keep pumping money into the system indefinitely?

- It seems like the answer is most likely no, as congress needs to approve such a thing and it’s doubtful this can actually go on forever.

- Why wouldn’t congress just allow the Fed to pump money in indefinitely?

- Without actual economic recovery (i.e. growth, value creation, GDP, etc…), you can’t lower interest rates any more and pump cash into the system without producing hyper-inflation. See Venezuela, Zimbabwe, etc… for why inflation is bad.

- So signs of economic recovery will, unintuitively, tank the equity markets?

- Yep. Once the Fed eases off on lowering interest rates and buying corporate assets, the cost of capital will go up, stock buy-backs will cease to keep up with the lower demand of equities, and prices will fall.

- Could the Fed pump the money somewhere else to help out?

- From a pure financial perspective, high-grade corporate bonds are arguably one of the safest bets out there to hopefully get repaid. However, in theory, that money could go toward buying local municipal bonds so schools, infrastructure, social programs, etc… could be funded.

- Would the Fed buying municipal bonds help spur growth, lower unemployment, etc...?

- While a ton of government and nonprofit jobs might be created, at the end of the day I’m not sure this is as effective as keeping large corporations afloat and small businesses alive with recent programs like PPP?